HOME > Investor Relations > Financial Indicators

Financial Indicators

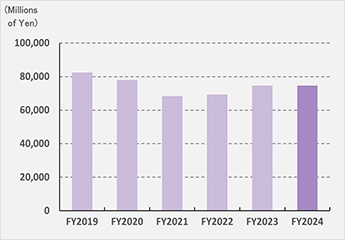

Net sales

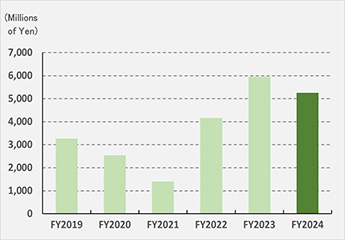

Operating income

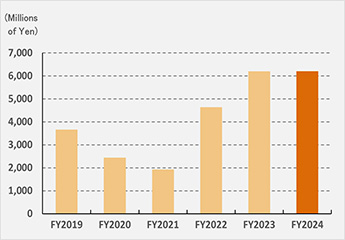

Recurring income

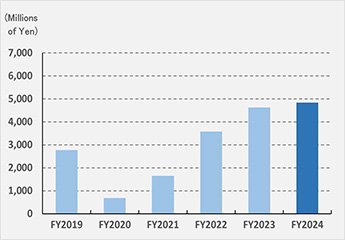

Net income

| Consolidated Operating Results (Millions of yen) |

FY2020 | FY2021 | FY2022 | FY2023 | FY2024 | FY2025 |

|---|---|---|---|---|---|---|

| Net sales | 78,066 | 68,434 | 69,313 | 74,655 | 74,602 | 78,723 |

| Cost of sales | 33,770 | 30,560 | 30,248 | 32,589 | 31,643 | 31,693 |

| Gross profit | 44,296 | 37,873 | 39,065 | 42,065 | 42,959 | 47,029 |

| Selling, general and administrative expenses |

41,752 | 36,478 | 34,900 | 36,110 | 37,702 | 40,846 |

| Operating income | 2,543 | 1,395 | 4,164 | 5,955 | 5,256 | 6,183 |

| Recurring income | 2,440 | 1,925 | 4,644 | 6,201 | 6,202 | 6,364 |

| Net income(loss) | 683 | 1,651 | 3,578 | 4,624 | 4,831 | 4,088 |

* Rounded down below millions of yen

| Consolidated Financial Position (at year-end) (Millions of yen) |

FY2020 | FY2021 | FY2022 | FY2023 | FY2024 | FY2025 |

|---|---|---|---|---|---|---|

| Current assets | 42,027 | 44,241 | 45,274 | 47,632 | 49,283 | 41,232 |

| Total assets | 80,224 | 81,764 | 81,829 | 84,773 | 88,628 | 88,911 |

| Current liabilities | 19,818 | 19,366 | 18,084 | 18,979 | 19,966 | 17,990 |

| Total shareholders' equity | 57,876 | 61,069 | 62,971 | 64,296 | 66,893 | 66,505 |

* Rounded down below millions of yen

| Per Share Data (yen) | FY2020 | FY2021 | FY2022 | FY2023 | FY2024 | FY2025* |

|---|---|---|---|---|---|---|

| Net income(loss) | 19.38 | 47.59 | 105.18 | 137.72 | 145.48 | 62.80 |

| Shareholders' equity | 1,667.56 | 1,759.56 | 1,866.58 | 1,924.95 | 2,036.34 | 1,037.20 |

| Cash dividends | 15 | 40 | 100 | 120 | 100 | 50 |

| Number of shares outstanding (in thousands) |

47,406 | 45,000 | 40,000 | 40,000 | 36,000 | 72,000 |

*The Company conducted a stock split at a ratio of 2 shares for every 1 share of common stock on January 1, 2025.

| Key Financial Ratios (%) | FY2020 | FY2021 | FY2022 | FY2023 | FY2024 | FY2025 |

|---|---|---|---|---|---|---|

| Operating income to net sales ratio |

3.3 | 2.0 | 6.0 | 8.0 | 7.0 | 7.9 |

| Return on sales | 0.9 | 2.4 | 5.2 | 6.2 | 6.5 | 5.2 |

| Return on assets | 2.9 | 2.4 | 5.7 | 7.4 | 7.2 | 7.2 |

| Return on equity | 1.1 | 2.8 | 5.8 | 7.3 | 7.4 | 6.1 |

| Equity ratio | 72.1 | 74.7 | 77.0 | 75.8 | 75.5 | 74.8 |